Bangkok, 11 March, 2020, at 13:00 Hrs. – The Royal Thai Government has approved Phase One of a broad range of financial and fiscal relief measures to help Thai companies, especially small and medium-sized enterprises, alleviate the business downturn impact of the COVID-19 virus crisis.

Travel and tourism companies are a primary focus of attention for the relief measures. Finance Minister Uttama Savanayana said that tourism, which accounts for 12% of the GDP, has been one of the worst affected sectors due to a 44% decline in visitors in February 2020. Chinese visitors alone were down 85%.

The downturn has had a significant ripple effect across the Thai economy affecting all forms of transport, trade and other services. Many hotels have temporarily suspended operations. The lack of liquidity also threatens the future of other businesses as well as employment levels.

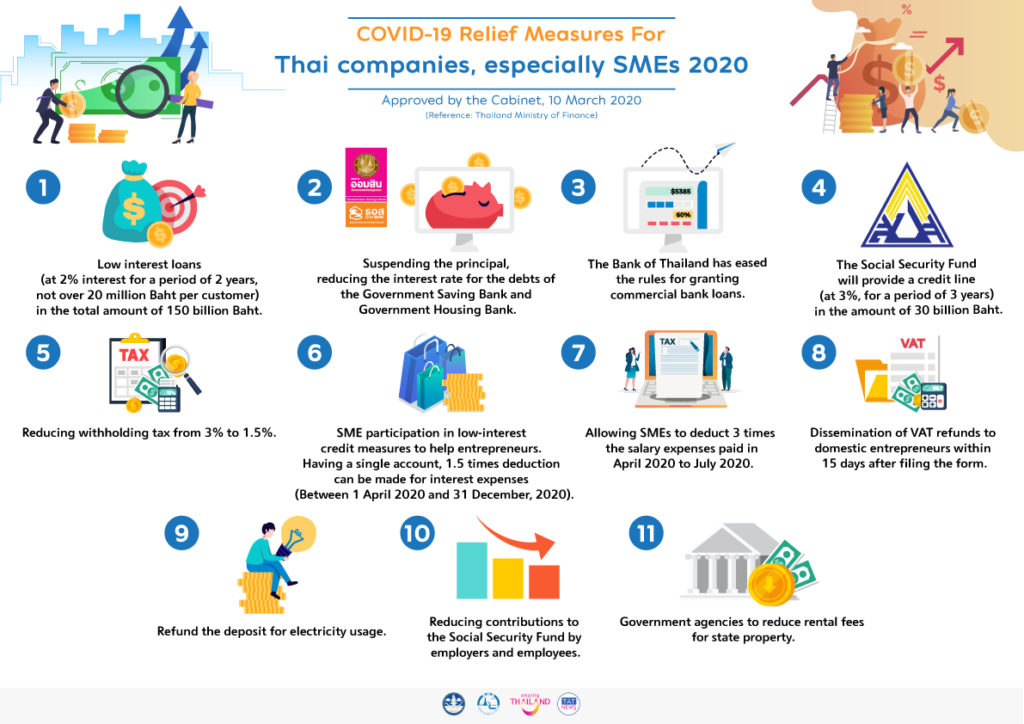

The package of relief measures was drafted by the Ministry of Finance based on the principles of “Timely, Targetted and Temporary as Necessary”. The measures, approved by the Thai Cabinet on 10 March, 2020, are as follows:

1) Low interest loans (at 2% interest for a period of 2 years, not over 20 million Baht per customer) in the total amount of 150 billion Baht.

2) Suspending the principal, reducing the interest rate for the debts of the Government Saving Bank and Government Housing Bank.

3) The Bank of Thailand has eased the rules for granting commercial bank loans.

4) The Social Security Fund will provide a credit line (at 3%, for a period of 3 years) in the amount of 30 billion Baht.

5) Reducing withholding tax from 3% to 1.5%.

6) Small and Medium Enterprises (SMEs) participating in low-interest credit measures to help entrepreneurs. Having a single account, 1.5 times deduction can be made for interest expenses that occur between 1 April, 2020 and 31 December, 2020,

7) Allowing SMEs to deduct 3 times the salary expenses paid in April 2020 to July 2020. For employees who are insured under the law on the Social Security Fund and receive wages of not more than 15,000 Baht per person per month.

8) Dissemination of VAT refunds to domestic entrepreneurs within 15 days after filing the form.

9) Refund the deposit for electricity usage.

10) Reducing contributions to the Social Security Fund by employers and employees.

11) Government agencies to reduce rental fees for state property.

The Finance Ministry has also set up specific hotlines to answer queries, as follows:

• Financial Measures, Tel: 0 2273 9020 Ext. 3235.

• Tax Measures, Tel: 0 2273 9020 Ext. 3509, 3529, and 3512.

• Measures to reduce contributions to the Social Security Fund of employers and employees / measures to build confidence in the capital market system, Tel: 0 2273 9020 Ext. 3643.

• Measures to alleviate the burden of fees, rental fees, and compensation for services provided by government agencies and state enterprises / measures to alleviate the burden of water and electricity bill payments / measures to assist those affected by the Coronary Infection Disease 2019 or COVID 19. Tel: 0 2273 9020 Ext. 3558.

• Measures to increase spending efficiency, budget expenditure for the fiscal year 2020, Tel: 0 2127 7000 Ext. 4588.

Tourism Authority of Thailand Governor Yuthasak Supasorn commented, “TAT has been in constant contact with the private sector, especially the industry associations, ever since the downturn began in late January. We have communicated their concerns and requests to the Ministry of Finance and all other branches of the Royal Thai Government.

“TAT deeply appreciates the rapid response of the Ministry of Finance, which should go some way towards helping travel and tourism companies survive the crisis.”